Travel Innovation: How Digital Wallets Win Over Customers

An analysis predicts that by 2026, over 5.2 billion people worldwide will be using digital wallets, a significant increase from current figures. In America, for instance, more than half (53%) of people now use digital wallets more often than traditional payment methods. Digital wallets will soon outpace traditional wallets everywhere if they haven’t already. No business can overlook this modern payment method, especially not the tourism industry. In this blog, we will discuss how digital wallets operate and their benefits in the travel payments workflow.

What is a Digital Wallet?

So, what exactly is a digital wallet? Think of it as a virtual version of your traditional wallet, but way smarter and more secure. It’s an application that allows you and your customers to carry out transactions online using various payment methods. These can range from the familiar credit and debit cards to more advanced options like preloaded funds, cryptocurrencies, and even Buy Now Pay Later (BNPL) services.

Instead of fumbling around with physical cards or typing in long strings of numbers every time you make a purchase, you simply tap or click to complete your transaction. It’s fast, it’s convenient, and it’s incredibly secure.

How do Digital Wallets Keep Your Sensitive Information Safe?

That’s where things get really interesting. Digital wallets use a variety of cutting-edge security measures, including data encryption, multi-factor authentication, and something called tokenization. Let’s break it down.

- Data encryption scrambles your payment information into a secret code that only you and the recipient can decipher.

- Multi-factor authentication adds an extra layer of protection by requiring you to verify your identity using multiple methods, such as a password and a fingerprint scan.

- Tokenization is a technology that replaces your actual payment details with a unique token. This means if there were ever a data breach, your real account numbers wouldn’t be exposed.

Types of Digital Wallets Used in Travel

Digital wallets are not a one-size-fits-all solution; they come in several forms, each serving distinct purposes and offering unique benefits. Let’s break them down:

1. Digital Wallet Apps

- Definition: These are the most recognized form of digital wallets, often B2C applications, that enable users to make online purchases, contactless payments at POS terminals, and peer-to-peer money transfers.

- Functionality: Beyond handling transactions, these apps can store digital versions of items typically found in physical wallets think tickets, IDs, gift cards, boarding passes, and more.

- Popular Examples: Apple Pay, Google Wallet, and Samsung Wallet stand out in this category, integrating seamlessly into users’ daily lives by centralizing payment and personal document management.

2. Closed-loop Wallets

- Definition: Operating within specific ecosystems, closed-loop wallets limit transactions to particular networks or companies. They’re not universal but tailored to enhance customer loyalty and streamline services within their domain.

- Use in Travel: Airlines may offer branded e-wallets to store loyalty cards, facilitate booking, and process onboard purchases. Similarly, Online Travel Agencies (OTAs) use these wallets to manage rewards, issue instant refunds, and promote repeated use through convenience and perks.

- Examples: Uber Cash and Walmart Pay exemplify general closed-loop wallets, while airline and OTA-specific wallets highlight their application in the travel sector.

3. B2B Wallets

- Definition: These digital wallets focus on facilitating transactions between businesses, such as between travel providers and suppliers, and are less common than B2C wallets.

- Functionality: While platforms like PayPal offer versatile solutions catering to both consumers and businesses, dedicated B2B wallets specialize in managing corporate transactions, offering features suited to the needs of businesses engaged in travel services.

Digital Wallet Apps

Digital wallets are clearly becoming the go-to payment method! You can find it interesting that, as reported by the Global Payment Report 2023 from FIS Global, digital wallet apps have now taken the lead as the primary payment method worldwide. They accounted for 49 percent of transaction value in 2022 and are anticipated to rise to 54 percent by 2026. Furthermore, at both points of sale and in eCommerce, they’re expected to see a remarkable growth, with a CAGR of 15 percent and 12 percent respectively by 2026.

Benefits of Digital Wallets: What is there for Your Travel Business?

A recent study by Juniper Research predicts that digital wallets will surpass 4.4 billion users by 2025. This sizable user base serves as a compelling incentive for OTAs and various travel enterprises to incorporate digital wallet functionality into their platforms. Here’s a breakdown of the key benefits of digital wallets can bring to your travel business:

1. Enhanced Customer Experience

- Who doesn’t appreciate a smooth and speedy checkout process? Digital wallets eliminate the need to manually enter card details each time, saving them valuable time and frustration.

- Plus, no more worries about forgetting a physical wallet or dealing with foreign currency exchange. Digital wallets offer a convenient all-in-one solution for travelers.

- Many wallets even offer loyalty programs and discounts, further enhancing the customer experience and potentially increasing customer satisfaction.

2. Reduced Costs

- Digital wallets are generally inexpensive to implement and maintain for your business. Transaction fees are typically charged to banks or other financial institutions, not directly to you or your customers (though some exceptions exist).

- In some cases, digital wallets bypass traditional credit card processing systems, potentially leading to even lower transaction fees compared to traditional card payments.

3. Improved Security

Digital wallets prioritize data security. Features like tokenization (replacing real card details with secure codes) and biometric authentication (fingerprint scans or facial recognition) ensure your customers’ financial information is protected.

4. Reaching New Customers

Digital wallets can be a gateway to new customer segments. In regions with limited access to traditional banking systems, mobile payments are often the preferred method. By adopting digital wallets, you open your services to a wider audience, including unbanked or underbanked populations.

Wallet Apps: How Do They Work?

1. Pass-Through Wallets: Security First

How about a digital wallet that acts like a secure extension of your physical credit or debit card? Well, that’s the idea behind pass-through wallets. Here’s how they work:

- Security Focus: These wallets prioritize security by storing tokens (unique digital codes) linked to your actual cards, not the sensitive card details themselves.

- Encrypted Information: When you initiate a transaction, the app transmits encrypted information (including the token) to the merchant.

- Network Verification: This encrypted information travels to a payment network where it’s decrypted and verified against your actual card details held by your issuing bank. Only the network and your bank see this real information.

- Transaction Approval: If everything checks out, the payment is approved, and funds are transferred from your bank to the merchant’s account.

Since pass-through wallets don’t store sensitive data or move funds themselves, they offer a high level of security. This makes them popular in regions with wide credit card adoption, like Europe and North America.

Examples: Popular pass-through wallets include Apple Pay, Samsung Wallet, and even some mobile banking apps like Chase Mobile.

2. Staged Wallets: More Features, More Control

Staged wallets offer a bit more functionality compared to pass-through options. Here’s what sets them apart.

Tokenized Details: Similar to pass-through wallets, staged wallets store tokens representing your payment methods.

Two-Stage Transactions: However, they handle transactions differently. Instead of passing information directly to the merchant, they operate in two stages:

- Funding Stage: First, the wallet acquires money from your chosen source – bank account, credit line, or even other wallets.

- Payment Stage: Then, in a separate step, it sends the funds to the merchant.

This two-stage approach allows the wallet provider to perform additional fraud checks before releasing funds. It also keeps some transaction details hidden from the payment network or card issuer compared to pass-through solutions.

Additional Features

Staged wallets often offer extra features like peer-to-peer transfers and support for cryptocurrencies. Some even allow storing funds directly within the wallet account.

Examples: Well-known staged wallets include PayPal, Google Wallet (formerly Google Pay), and Cash App (available in the US and UK only).

3. Stored Value Wallets: Convenience for All

Think of stored-value wallets like prepaid cards. Here’s how they function:

Pre-loading Required:

Before making a purchase, you need to add funds to the wallet’s balance. This can be done from your bank account, debit/credit card, peer-to-peer transfer, or other options depending on the provider.

Direct Merchant Payment:

When you make a purchase, the merchant withdraws funds directly from your wallet balance.

Stored value wallets are particularly popular in regions with limited access to traditional banking. They allow people to participate in the digital economy even without a bank account.

Examples: Some popular stored value wallets include Apple Cash (US only), Alipay (China’s leading e-wallet), WeChat Pay, and Paytm Wallet (India’s largest platform for instant payments).

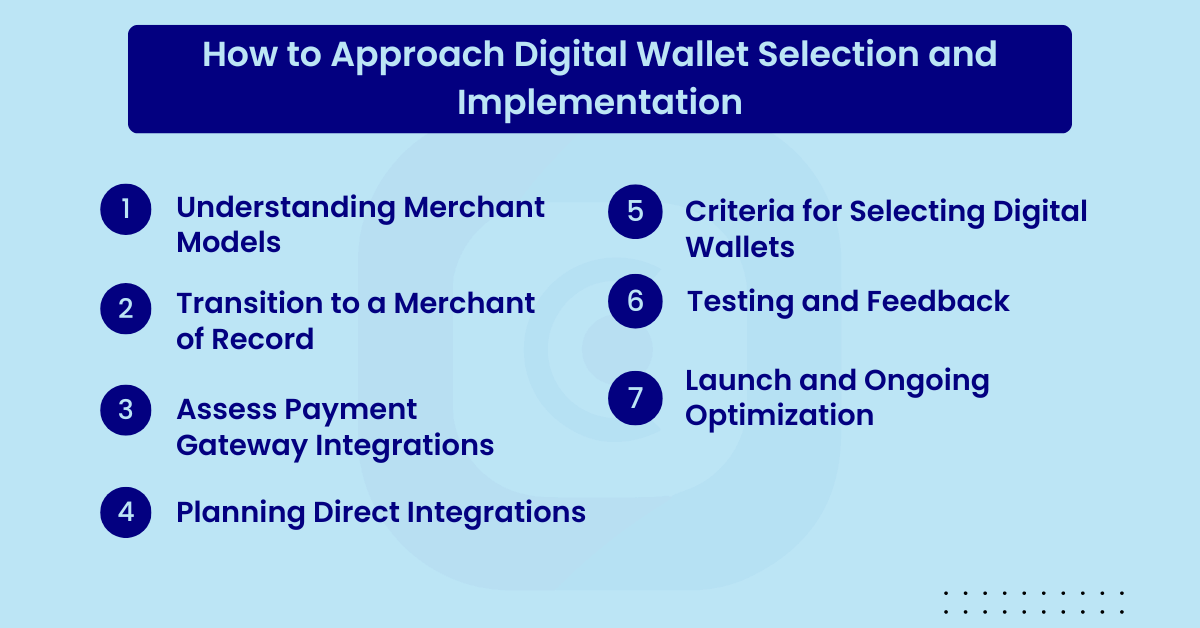

How to Approach Digital Wallet Selection and Implementation

1. Understanding Merchant Models

- Agent vs. Merchant of Record: Before diving into digital wallets, determine if your business operates under an agent model (where you simply forward transactions to suppliers) or if you’re a merchant of record (MoR). The latter means you have the authority to process transactions directly.

- Benefits of Being a MoR: As a merchant of record, you gain control over financial transactions, which allows for more flexibility in selecting payment methods, including digital wallets.

2. Transition to a Merchant of Record

If you’re not already a MoR, consider transitioning to this model. It gives you direct control over your financial processes and enables you to decide which digital wallets and other payment methods to integrate into your platform.

3. Assess Payment Gateway Integrations

- Review Current Partnerships: Start by checking which digital wallets are already compatible with your existing payment gateway. Most gateways support a range of global and local digital wallets.

- Integration Process: Understand that the integration process varies. Some wallets might be activated swiftly, while others could need more comprehensive setup. Your gateway provider can offer guidance or technical support.

4. Planning Direct Integrations

- Identify Gaps: If certain desired wallets aren’t supported by your payment gateway, you’ll need direct integration.

- Documentation and Development: Wallet providers typically offer API documentation for integration. However, crafting a direct connection will require formal agreements with providers and development efforts from your team.

5. Criteria for Selecting Digital Wallets

When choosing which wallets to integrate, consider:

- Flexibility: Opt for wallets that aren’t restricted to specific platforms.

- User Base: Consider the global reach and user adoption rates.

- Regional Popularity: Pay attention to wallets with high penetration in your target markets.

- Supported Payment Methods: Ensure the payment wallet supports diverse payment options.

- Currency Support: Look for multi-currency capabilities to cater to international customers.

- Security: Prioritize wallets known for robust security measures.

- Transaction Fees: Be aware of the costs associated with each transaction.

Platform Compatibility: Ensure the wallet can be seamlessly integrated into your existing platform.

6. Testing and Feedback

- Pilot Testing: Conduct pilot tests with a small group of users to identify any issues or areas for improvement.

- Feedback Loop: Establish a feedback mechanism to collect user input on the mobile wallet experience, making adjustments as needed.

7. Launch and Ongoing Optimization

- Official Launch: Roll out the online wallet integration to all users, accompanied by user education and marketing efforts to increase adoption.

- Monitor and Optimize: Continuously monitor transaction volumes, user feedback, and technical performance to optimize the e-wallet experience over time.

Global vs. Local Wallets

Combining Wallets for Market Coverage

A mix of global wallets (like PayPal, Apple Pay, and Google Wallet) and local methods (such as iDEAL in the Netherlands or Bancontact in Belgium) ensures comprehensive market coverage.

Target Market Considerations

Tailor your wallet selection to the specific needs and preferences of the regions you operate in. For instance, in European markets, including region-specific options alongside global giants can maximize customer convenience and satisfaction.

Closed-loop e-Wallets in Travel

Beyond Open Wallets: Exploring Closed-Loop Systems for Your Travel Business

We’ve discussed open-loop digital wallets – those versatile tools that allow customers to pay across different businesses. But what about closed-loop wallets? Closed-loop wallets are internal payment systems that allow transactions only within a specific brand and its partners. Unlike open-loop wallets, which offer broad versatility across different merchants, closed-loop systems focus on a narrower, brand-centric ecosystem.

Let’s see if these brand-specific options might be a good fit for your travel business.

1. Enhanced Loyalty Programs:

- Benefit Accumulation: Closed wallets facilitate seamless management of loyalty programs, enabling users to earn and redeem points, access discounts, and utilize cashback rewards effortlessly.

- Customer Engagement: By offering attractive rewards and incentives, closed-loop wallets enhance customer loyalty and foster deeper engagement with your brand.

2. Expedited Refunds:

- Instant Availability: In case of trip cancellations or refunds, closed-loop wallets provide immediate reimbursement to users, eliminating the waiting period associated with traditional bank processing.

- Cost Savings: Businesses save on service fees by processing refunds internally, while customers enjoy quicker access to their funds for future purchases.

3. Increased Repeat Purchases:

- Incentivized Spending: Refunds credited directly to the wallet incentivize users to make repeat purchases within the same ecosystem, driving revenue and customer retention.

- Ecosystem Retention: Keeping customer payments within your ecosystem enhances the potential for additional sales and service offerings.

4. Access to Customer Data:

- Data Insights: Operating a closed-loop wallet allows you to gather detailed data on customer spending habits, preferences, and loyalty program interactions.

- Personalization Opportunities: Leveraging this data, you can tailor product recommendations, marketing messages, and special offers to individual customer preferences, significantly enhancing personalization and the overall customer experience.

In a nutshell, closed-loop wallets create a win-win scenario. They offer a smoother experience for your customers and foster brand loyalty, ultimately driving repeat business.

B2B Wallets in Travel

We’ve discussed consumer-facing digital wallets that simplify travel bookings for your customers. But what about streamlining payments between your business and travel suppliers? B2B wallets have emerged as a more modern approach to handling those transactions.

Traditionally, travel businesses relied on methods like checks, bank transfers, and corporate credit cards for B2B transactions. These methods can be:

- Time-consuming: Waiting for checks to clear or for bank transfers to process can significantly delay settlements.

- Prone to Errors: Manual data entry during payments can lead to errors and delays.

- Limited Functionality: Traditional methods lack features for expense tracking, budgeting, or real-time transaction monitoring. B2B wallets offer a modern alternative. They function like secure digital accounts where you can:

- Store Funds: Pre-deposit funds in your preferred currencies for future transactions.

- Manage Payments: Easily transfer funds to suppliers quickly and efficiently.

- Track Expenses: Monitor spending with built-in expense tracking features.

- Set Limits: Control spending with customizable spending limits for different agents.

- Receive Notifications: Get instant updates on completed payments.

- Sub-Wallets: Create separate accounts for different agents or departments within your agency (depending on the platform).

To get a clearer picture of B2B wallets, let’s explore two platforms specifically designed for the travel industry

1. Amadeus B2B Wallet: Juggling EARN and SAVE Virtual Cards

Core Concept: Amadeus B2B Wallet is essentially a secure account, or “wallet,” that your business needs to fund in advance. Upon your request, it generates virtual cards, loading them with money from your balance to settle payments with suppliers such as hotels and airlines.

The Power of Choice: EARN vs. SAVE

- Visa SAVE Card: This card is designed to help your business minimize or completely dodge surcharges often imposed by low-cost and some full-service carriers. It’s versatile, supporting USD, GBP, and EUR, making it a global solution for various business transactions.

- MasterCard EARN Card: Unlike the SAVE card, the EARN card offers rebates on specific purchases. It’s available in 8 currencies but is restricted to payments within the travel and hospitality sectors.

Customizable Options:

- Flexibility: You have the flexibility to impose restrictions on card usage, such as setting specific timeframes or spending limits, providing you with greater control over your transactions.

- Simplified Reconciliation: Upon completion of transactions, the platform automatically generates comprehensive reports consolidating booking and payment data. This feature simplifies the reconciliation process, enhancing efficiency and accuracy.

Integration Capabilities:

- Amadeus Selling Platform Connect: Amadeus B2B Wallet comes pre-connected with Amadeus Selling Platform Connect, streamlining the integration process for users of this platform

- XML Web Services: For other platforms, integration with the wallet’s functionality is facilitated through XML web services, broadening its applicability across different systems.

Strategic Advantages for Your Business:

- Tailored Financial Strategy: With the SAVE and EARN cards at your disposal, you’ve got the power to shape your financial approach precisely. Opt for the SAVE card to cut down on those pesky surcharges, directly boosting your bottom line. Or, pick the EARN card to snag some sweet rebates on your purchases. It’s all about what works best for your company’s financial health.

- Enhanced Security and Discipline: Ever worry about going over budget or falling victim to fraud? Those concerns take a backseat with the ability to closely monitor and control card usage. Set limits, define usage periods, and sleep a little easier knowing you’ve got a tight rein on your finances.

- Streamlined Financial Admin: Let’s face it, reconciling transactions can be a headache. But with integrated reporting, you’re getting a neat package of data that simplifies this chore. Less time on paperwork means more time focusing on what matters growing your business.

Strategic Advantages for Your Customers

- Better Deals and Rewards: Who doesn’t love a good deal? By harnessing the power of the Amadeus B2B Wallet, you’re in a prime position to offer your customers more bang for their buck. Competitive pricing and attractive rewards are surefire ways to keep them coming back for more.

- Top-notch Transaction Experience: In today’s world, smooth and reliable transactions are non-negotiable for customers. The efficiency and dependability of the Amadeus B2B Wallet not only meet these expectations but can exceed them, elevating your customer service to new heights and encouraging loyal customers to stick around.

2. IATA EasyPay: a low-cost payment method for small and mid-sized travel agencies

What is IATA EasyPay?

A Cost-Effective Solution:

Think of IATA EasyPay as a financial Swiss Army knife for small to mid-sized travel agencies. It’s designed as a secure, speedy, and cost-efficient alternative to the traditional cash payments system utilized by IATA’s Billing and Settlement Plan (BSP).

Who Can Use It?

If you’re an IATA-accredited travel agent, this tool is tailored just for you. It’s perfect for purchasing airline tickets without the cumbersome financial guarantees often required.

How Does It Work?

- Setting Up: To get started, you create an EasyPay account in your local currency through the IATA Customer Portal. Then, you top it up via bank transfer.

- Making Transactions: For each transaction, you’ll use a unique 16-digit code instead of revealing credit card details. This code is used within any Global Distribution System (GDS) to secure bookings. The funds for the booking are reserved and then transferred to the airline through IATA’s efficient clearing process.

Key Advantages

- No Financial Guarantees Needed: Because it’s a prepaid system, there’s no need for financial guarantees to cover potential non-payment risks. This feature is particularly beneficial for agencies working under a Remittance Holding Capacity, allowing them to keep issuing tickets even if they’ve hit their billing period’s limit.

- Benefits for Travel Agencies and Airlines: For smaller travel agencies, IATA EasyPay opens up the opportunity to issue tickets more freely. Airlines find it an attractive option too, thanks to the guaranteed payments, reduced fraud risk, and swift fund transfers.

Considerations

- No Credit Line: One caveat is that EasyPay doesn’t offer a credit line, meaning you’ll need to prefund your purchases. While this works well for smaller agencies, it may not be ideal for larger ones that can’t feasibly prefund all transactions.

Paul van Alfen, a renowned Travel Payment Strategist, sums it up perfectly by highlighting how EasyPay empowers smaller travel agencies to issue tickets hassle-free. At the same time, he notes its limitation for larger agencies that may not be able to prefund all purchases due to the absence of a credit line.

Strategic Advantages for Your Business

- Reduced Operating Costs: By eliminating the need for financial guarantees and leveraging a low-cost payment method, your agency can significantly reduce the overhead associated with ticket purchases. This efficiency translates to better cash flow management and potential savings that can be redirected toward growth initiatives.

- Enhanced Security: The unique 16-digit transaction code system minimizes the risk of fraud and unauthorized access to sensitive payment information. This not only protects your transactions but also enhances your agency’s reputation as a secure partner.

- Increased Operational Flexibility: For agencies under a Remittance Holding Capacity, IATA EasyPay allows for continued ticket issuance beyond set billing limits, ensuring business continuity and customer satisfaction without financial strain.

- Improved Cash Flow: The prepaid nature of EasyPay ensures that funds are readily available for transactions, leading to quicker settlements with airlines and a more predictable cash flow.

Strategic Advantages for Your Customers

- Seamless Booking Experience: Your customers benefit from a streamlined booking process, free from the delays that can accompany traditional payment verifications and transfers. This efficiency can significantly enhance the overall customer experience.

- Trust and Security: Knowing that their travel agency employs a secure, IATA-endorsed payment method adds an extra layer of trust for your customers. The assurance that their bookings are made through a fraud-resistant system can be a strong selling point.

- Access to More Options: The agility afforded by EasyPay allows you to offer a broader range of ticketing options, including last-minute deals and promotions that may require immediate payment, giving your customers more flexibility and choice.

- Expedited Refunds: In the event of cancellations or changes, the prepaid nature of EasyPay can facilitate quicker refunds, enhancing customer satisfaction and loyalty.

Digital Wallets as Must-haves to Retain Customers

Whether you choose a global giant or a local favorite, remember: the chosen wallet should enhance, not hinder, the booking experience. Here are the golden rules:

- User-Friendly: Your chosen digital wallet should make life easier, not more complicated. A straightforward, hassle-free experience is key.

- Tight Security: In today’s digital age, safeguarding your customers’ information is paramount. A secure wallet is a trustworthy wallet.

- Dependable: A reliable digital wallet ensures smooth sailing for every transaction, cementing your reputation as a brand that delivers.

- Local vs. Global Solutions: While larger travel companies often integrate with global wallets like Apple Pay, Google Wallet, and PayPal, there’s growing recognition of the value in adopting local wallet options.