What is 3D Secure? Benefits of Using 3D Secure

3D Secure is a security protocol that adds a layer of security for online credit card and debit card transactions.

This process is familiar to customers through card brand names such as Visa Secure (formerly Verified by Visa) and Mastercard Identity Check/ MasterCard Secure Code. Other card issuers use 3D secure as JCB J/Secure and American Express SafeKey.

Where is the 3D secure layer added in the transaction process?

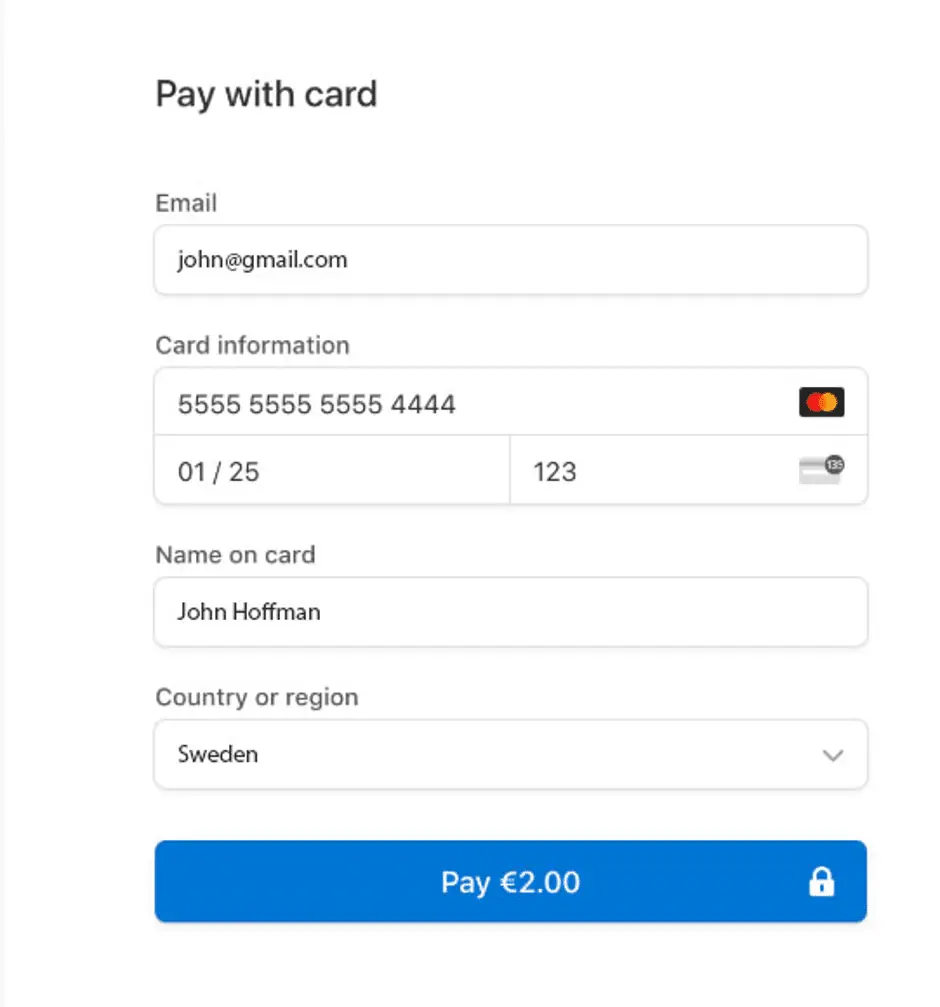

This advanced security (3D Secure) requires customers to complete additional verification steps with the card issuer when paying.

- Typically, the customer is directed to an authentication page on their bank’s website or the authorization is completed within your payment solution.

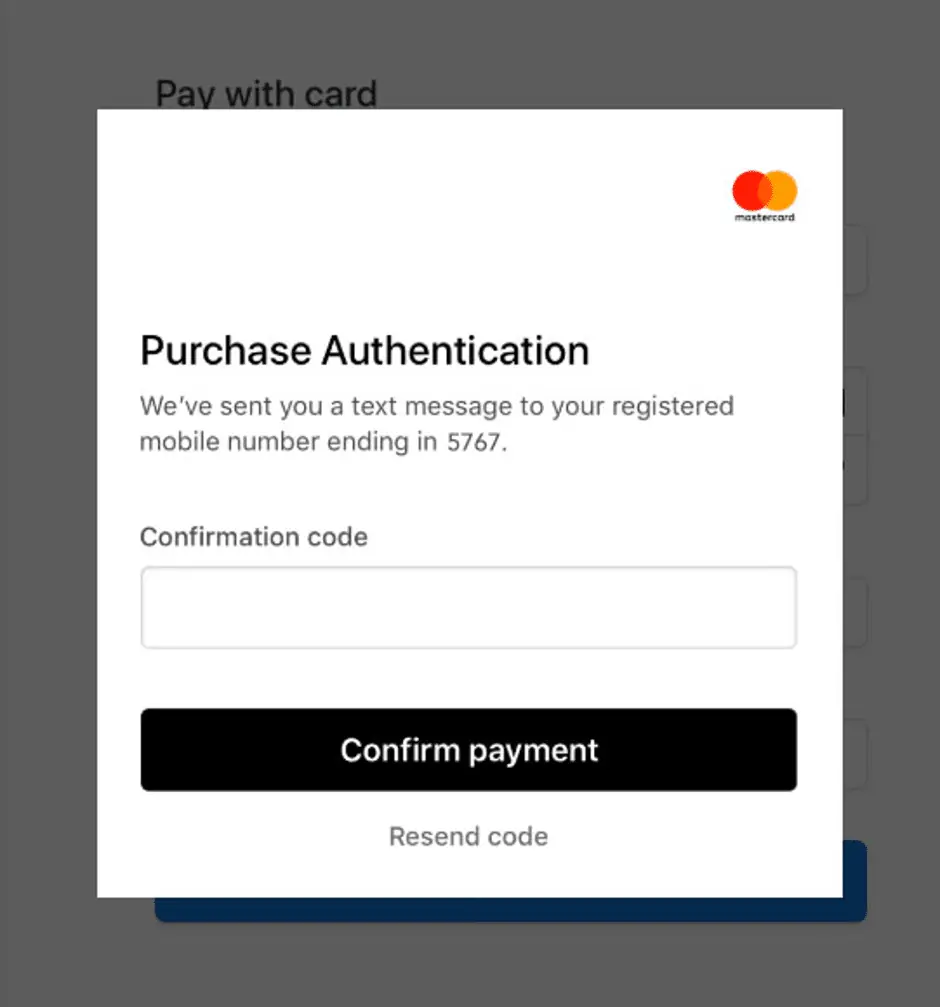

- Then they enter a password associated with the card or a code sent to their phone.

- If the customer is not enrolled in Verified by Visa or MasterCard SecureCode, then the customer is prompted to enroll and create a password/pin. The cardholder can decline registration, but opt-out chances are limited. It is up to the credit card issuer to define the maximum number of opt-out occurrences and the actions to be taken after the maximum is.

- A merchant can decide which transactions require 3D Secure authentication. For example, a merchant can identify high-risk transactions and can secure such a transaction with 3D Secure.

Step 1: Payment screen for any purchase on the web

Step 2: 3D secure authorization screen for confirmation code

What are the Benefits of Using 3D Secure?

Benefits to the merchant:

- Liability shift: If the cardholder raises a flag of fraudulent payment, the liability shifts from you to the card issuer.

- Customer confidence: Many customers will feel more confident knowing there is an extra level of security in place to protect their transactions.

Benefits to the customer:

- Reduced Risk Fraud: The requirement of your 3D Secure PIN prevents unauthorized usage of your Card on the Internet, giving you more confidence about making secure purchases online.

- Increased Protection: 3D Secure authorization requires confirmation of identity, code, OTP (one-time-password), etc. from the card issuer.

We feel it is a win-win situation for merchants and customers both and investing in 3D secure technology is a worth investment for merchants.

Our team is having over ten years of experience in diversified domains like Travel, IoT, and health care and has developed applications with different types of payment gateways like stripe, etc. For further information please feel free to contact us.